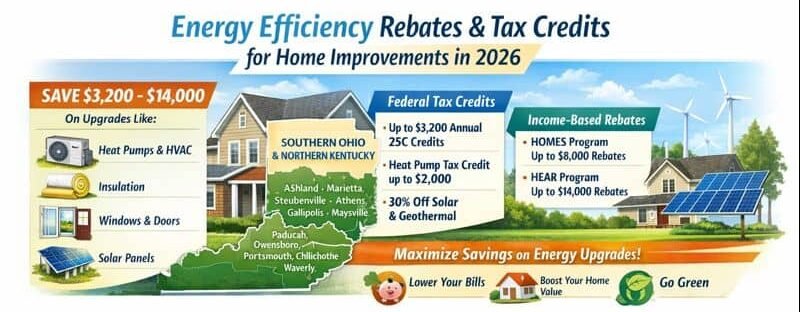

Energy efficiency rebates and tax credits for home improvements in Southern Ohio and Northern Kentucky can reduce your renovation costs by $3,200-$14,000 or more when you upgrade HVAC systems, insulation, windows, and other efficiency measures. If you live in Ashland, Marietta, Steubenville, Athens, Gallipolis, Mt. Orab, Maysville, Paducah, Owensboro, Henderson, Portsmouth, Chillicothe, or Waverly, understanding available federal tax credits, state rebates, and utility incentive programs helps you maximize savings on essential home improvements.

Most homeowners throughout our region remain unaware of the substantial financial incentives available through the Inflation Reduction Act, state-level efficiency programs, and local utility rebates. These programs have expanded dramatically since 2023. They offer unprecedented savings opportunities for heat pump installations, insulation upgrades, electrical panel replacements, and weatherization projects.

This comprehensive 2026 guide covers all current rebate and tax credit programs available to homeowners interested in remodeling in Southern Ohio and Northern Kentucky. We’ll explain eligibility requirements, application processes, income limits where applicable, and strategic timing to maximize your total incentives. Understanding these programs transforms expensive efficiency upgrades into affordable investments with shortened payback periods and immediate savings.

Federal Tax Credits Under the Inflation Reduction Act

The Inflation Reduction Act of 2022 created the most generous federal tax credit programs for home energy improvements in U.S. history. These programs extend through 2032 with expanded coverage and increased credit amounts. Tax credits reduce your federal income tax liability dollar-for-dollar, making them more valuable than tax deductions.

Energy Efficient Home Improvement Credit (25C)

The Energy Efficient Home Improvement Credit provides tax credits up to $3,200 annually for specific improvements. Qualifying upgrades include heat pumps, heat pump water heaters, biomass stoves, insulation, air sealing, windows, doors, electrical panel upgrades, and home energy audits.

This credit replaces the previous $500 lifetime limit with annual $3,200 maximum credits. Homeowners can claim credits multiple years for different improvements.

Heat Pump Tax Credits

Heat pumps and heat pump water heaters qualify for 30% tax credits up to $2,000 annually. This covers both equipment and installation costs.

A $6,000 cold climate heat pump installation throughout Ashland, Marietta, or Steubenville generates a $1,800 tax credit. A $1,800 heat pump water heater provides a $540 credit. Installing both improvements in the same year qualifies for separate credits totaling $2,340.

Insulation and Air Sealing Credits

Insulation and air sealing qualify for 30% tax credits up to $1,200 annually. This covers both materials and installation.

A $4,000 attic insulation upgrade throughout Athens, Gallipolis, or Portsmouth generates a $1,200 tax credit. A $2,500 crawl space insulation project provides a $750 credit. The $1,200 annual cap applies to total insulation and air sealing improvements combined, not per project.

Window and Door Credits

Windows and exterior doors receive 30% tax credits with specific annual limits. The maximum is $600 for windows and skylights, and $500 for exterior doors with a $250 limit per door.

A $3,000 window replacement project generates a $600 credit (30% of $2,000, capped at $600). Replacing two exterior doors for $1,200 total provides a $360 credit.

Electrical Panel Upgrade Credits

Electrical panel upgrades qualify for 30% tax credits up to $600. The upgrade must be necessary to accommodate efficiency improvements like heat pumps or EV chargers.

A $2,500 electrical panel upgrade from 100 amps to 200 amps in Chillicothe, Waverly, or Henderson generates a $600 credit. This applies when paired with qualifying equipment installations requiring increased electrical capacity.

Home Energy Audit Credits

Home energy audits receive 30% tax credits up to $150 for professional assessments. These audits identify efficiency improvement opportunities throughout your home.

A $500 comprehensive energy audit throughout Owensboro, Maysville, or Mt. Orab generates a $150 credit. The audit also provides detailed recommendations for improvements that qualify for additional credits.

Residential Clean Energy Credit (25D)

The Residential Clean Energy Credit provides 30% tax credits with no annual or lifetime limits. Qualifying systems include solar panels, solar water heaters, geothermal heat pumps, small wind turbines, battery storage, and fuel cells. These credits cover equipment and installation costs.

Solar Panel Tax Credits

Solar photovoltaic systems qualify for 30% tax credits on total installed costs. This includes panels, inverters, mounting hardware, and installation labor.

A $20,000 solar array installation in Paducah, Steubenville, or Marietta generates a $6,000 tax credit with no upper limit. A $35,000 system provides a $10,500 credit.

Geothermal Heat Pump Credits

Geothermal heat pumps receive 30% tax credits on complete system costs. This includes ground loops, heat pump equipment, and installation.

A $25,000 geothermal installation throughout Athens, Gallipolis, or Portsmouth provides a $7,500 tax credit. This substantially reduces the premium over conventional HVAC systems.

Battery Storage System Credits

Battery storage systems qualify for 30% tax credits when charged primarily by solar panels or other renewable energy systems. This provides backup power during outages common throughout our region.

A $12,000 home battery backup system in Ashland or Henderson generates a $3,600 tax credit when paired with solar panels.

Income-Based Federal Rebate Programs (HOMES and HEAR)

The Inflation Reduction Act created two substantial rebate programs specifically for low- and moderate-income households. Implementation timing varies by state. These rebates provide point-of-sale discounts rather than tax credits, making improvements immediately affordable without waiting for tax refunds.

Home Efficiency Rebates (HOMES) Program

The Home Efficiency Rebates program provides rebates up to $8,000 for whole-home energy efficiency improvements. Homes must reduce energy consumption by at least 20%. Ohio and Kentucky are developing implementation plans with expected launch dates in late 2025 or early 2026.

HOMES Rebate Amounts

Rebate amounts under HOMES scale with energy savings achieved. A 20% energy reduction qualifies for rebates up to $2,000. A 25% reduction provides up to $4,000. A 30% reduction offers up to $6,000. A 35%+ reduction delivers maximum $8,000 rebates.

Households earning below 80% of area median income receive higher rebates. Maximums increase to $8,000 for those earning under 80% AMI.

HOMES Eligible Improvements

Eligible improvements under HOMES include insulation, air sealing, HVAC equipment, duct sealing, heat pumps, and heat pump water heaters. Windows, doors, and smart thermostats also qualify when part of comprehensive efficiency packages.

Energy modeling before and after improvements verifies savings percentages for rebate qualification.

Home Electrification and Appliance Rebates (HEAR)

The Home Electrification and Appliance Rebates program provides point-of-sale rebates up to $14,000. This serves households earning below 150% of area median income. Like HOMES, Ohio and Kentucky implementation remains pending with expected availability in 2025-2026.

HEAR Heat Pump Rebates

Heat pump HVAC systems qualify for HEAR rebates up to $8,000 for households earning below 80% AMI. Those earning 80-150% AMI receive up to $4,000.

This substantial rebate stacks with 25C tax credits. A $12,000 heat pump installation throughout Steubenville, Marietta, or Ashland could drop to $2,000-$4,000 net cost after all incentives.

HEAR Appliance and Equipment Rebates

Heat pump water heaters receive HEAR rebates up to $1,750 (below 80% AMI) or $875 (80-150% AMI). These combine with 25C tax credits for total savings of $2,290-$2,625 on $2,500 installations.

Electric stoves and ovens qualify for up to $840. Electric heat pump clothes dryers receive up to $840. Breaker box upgrades qualify for up to $4,000.

HEAR Weatherization Rebates

Insulation, air sealing, and weatherization qualify for HEAR rebates up to $1,600. This provides additional assistance for low-income households beyond HOMES program savings.

Electric load service center upgrades receive up to $2,500 for households earning below 80% AMI. Those earning 80-150% AMI receive up to $1,250.

Income Limits for HEAR and HOMES

Income limits for HEAR and HOMES programs vary by county and household size. Area Median Income data for Southern Ohio counties including Scioto (Portsmouth), Lawrence (Ashland area), Washington (Marietta), and Athens counties differ from Northern Kentucky counties.

Homeowners should verify specific AMI thresholds through state program administrators once programs launch.

Ohio-Specific Rebate and Incentive Programs

Ohio utility companies offer various rebate programs for energy efficiency improvements. Availability and amounts vary significantly by service territory. Duke Energy Ohio, AEP Ohio, and Dayton Power & Light provide the most comprehensive residential efficiency programs for homeowners throughout Southern Ohio.

Duke Energy Ohio Rebate Programs

Duke Energy Ohio serves parts of Southern Ohio including areas around Cincinnati. The company provides substantial residential rebates through its Home Energy House Call program. Qualified contractors can access instant rebates for customers.

Duke Energy Smart Thermostat Rebates

Smart thermostats receive $100 instant rebates through Duke Energy Ohio when installed by participating contractors. Ecobee, Honeywell, and Nest thermostats qualifying for rebates must meet Energy Star requirements. They must also connect to WiFi for demand response participation.

Homeowners in Mt. Orab and surrounding Duke service territories can combine these rebates with 25C tax credits.

Duke Energy Insulation Rebates

Duct sealing and insulation improvements qualify for up to $600 in rebates through Duke Energy Ohio’s programs. Work must be performed by qualified contractors and meet specified R-value improvements.

Attic insulation upgrades to R-49 or higher throughout Duke service areas receive substantial rebates that stack with federal tax credits.

Duke Energy Heat Pump Rebates

Heat pump installations receive variable rebates through Duke Energy Ohio depending on system efficiency ratings. High-efficiency cold climate heat pumps with HSPF2 ratings of 9.5+ and SEER2 ratings of 16+ qualify for maximum rebates. Duke adjusts amounts periodically based on program funding and participation levels.

AEP Ohio Rebate Programs

AEP Ohio serves extensive territories throughout Southern Ohio including areas around Athens, Gallipolis, Portsmouth, Chillicothe, and Waverly. The AEP Ohio Residential Energy Efficiency Program offers rebates for HVAC equipment, insulation, air sealing, and smart home technologies.

AEP Ohio HVAC Equipment Rebates

HVAC equipment rebates through AEP Ohio provide $250-$750 depending on system type and efficiency. Central air conditioners meeting 15 SEER2+ ratings qualify for $250 rebates. Heat pumps with 8.5+ HSPF2 ratings receive $500-$750 rebates.

These utility rebates combine with federal tax credits for substantial total savings.

AEP Ohio Insulation Rebates

Insulation rebates through AEP Ohio vary by improvement type and R-value increases. Attic insulation additions bringing total R-values to R-38+ qualify for rebates of $0.15-$0.30 per square foot. This depends on starting insulation levels.

Wall insulation and basement insulation improvements receive similar per-square-foot rebates when meeting program requirements.

AEP Ohio Air Sealing Rebates

Air sealing improvements receive AEP Ohio rebates when performed by qualified contractors. Blower door testing must verify air leakage reductions.

Whole-home air sealing achieving 15%+ reductions in air changes per hour qualifies for rebates up to $400. This proves particularly valuable when combined with insulation upgrades.

AEP Ohio Additional Rebates

Smart power strips, LED lighting, and energy monitoring devices qualify for small rebates through AEP Ohio’s online marketplace. While individual rebates remain modest ($5-$25), purchasing multiple items during home efficiency upgrades generates cumulative savings worth claiming.

Dayton Power & Light Programs

Dayton Power & Light serves limited areas of Southern Ohio with residential efficiency programs similar to AEP Ohio offerings. Homeowners should verify their specific utility provider and available programs, as service territories create patchwork coverage throughout our region.

Kentucky-Specific Rebate and Incentive Programs

Kentucky utility companies including Kentucky Power, Duke Energy Kentucky, and Louisville Gas & Electric/Kentucky Utilities offer efficiency rebates for Northern Kentucky homeowners. Program generosity varies significantly by provider.

Duke Energy Kentucky Programs

Duke Energy Kentucky serves Northern Kentucky including areas around Maysville. The company provides residential efficiency programs similar to Duke Energy Ohio but with some differences in rebate amounts and qualifying equipment.

Homeowners in Maysville should verify specific program details through Duke Energy Kentucky rather than assuming Ohio program terms apply.

Duke Energy Kentucky Heat Pump Rebates

Heat pump rebates through Duke Energy Kentucky range from $300-$1,000 depending on equipment efficiency. The amount also depends on whether systems replace electric resistance heating or existing heat pumps.

Cold climate heat pumps with HSPF2 ratings of 10+ qualify for maximum rebates. This proves particularly valuable given Northern Kentucky’s heating-dominated climate.

Duke Energy Kentucky Insulation Rebates

Insulation and air sealing improvements qualify for Duke Energy Kentucky rebates when performed by participating contractors. Energy assessments must verify the work.

Attic insulation, wall insulation, crawl space insulation, and air sealing improvements all receive per-square-foot or percentage-based rebates depending on project scope.

Duke Energy Kentucky Smart Thermostat Rebates

Smart thermostat rebates through Duke Energy Kentucky provide $50-$100 instant rebates. Installation must be by qualified contractors or through approved retailers.

These rebates require enrollment in demand response programs. Utilities can make minor temporary adjustments during peak demand periods in exchange for ongoing bill credits.

Kentucky Power Programs

Kentucky Power serves parts of Eastern Kentucky including areas near Ashland. The company offers residential efficiency programs through its Kentucky Power Energy Efficiency Program. Rebates for HVAC equipment, water heaters, and insulation help offset improvement costs for homeowners in Boyd County and surrounding areas.

Kentucky Power HVAC Rebates

HVAC equipment rebates through Kentucky Power provide $200-$600 for high-efficiency air conditioners, heat pumps, and furnaces. Equipment must meet specified efficiency requirements.

Ductless mini-split heat pumps qualify for rebates when replacing electric resistance heating or when adding conditioning to previously unconditioned spaces.

Kentucky Power Water Heater Rebates

Water heater rebates through Kentucky Power include $300 for heat pump water heaters. Tankless gas water heaters meeting Energy Factor requirements receive $200.

These rebates stack with federal 25C tax credits, making heat pump water heater upgrades particularly cost-effective for Ashland-area homeowners.

Louisville Gas & Electric and Kentucky Utilities (LG&E/KU)

Louisville Gas & Electric and Kentucky Utilities serve extensive Kentucky territories including areas around Paducah, Owensboro, and Henderson. Their residential energy efficiency programs offer rebates for HVAC, insulation, lighting, and appliances through contractor partnerships and online marketplaces.

LG&E/KU Heat Pump Rebates

Heat pump and air conditioner rebates through LG&E/KU range from $100-$700 depending on equipment type and efficiency. Central air conditioners with SEER2 ratings of 16+ qualify for $350 rebates.

Heat pumps with 9+ HSPF2 ratings receive $500-$700 rebates. These programs specifically encourage heat pump adoption to reduce electric resistance heating common throughout Western Kentucky.

LG&E/KU Insulation Rebates

Insulation rebates through LG&E/KU provide per-square-foot reimbursement for attic, wall, and floor insulation improvements. Work must meet R-value requirements.

Contractors participating in LG&E/KU programs can access instant rebates. This simplifies the application process for homeowners in Paducah, Owensboro, and Henderson.

Kentucky Weatherization Assistance

Weatherization assistance programs through Kentucky Housing Corporation serve low-income households. They provide comprehensive efficiency improvements at no cost.

Eligible households receive attic insulation, air sealing, duct sealing, minor repairs, and HVAC improvements free of charge. Income limits vary by household size and county.

Strategic Timing and Stacking Multiple Incentives

Maximizing total incentives requires strategic planning around tax credit annual limits, utility rebate program funding cycles, and anticipated launch dates for HOMES and HEAR rebate programs. Understanding how various incentives stack creates opportunities for dramatic cost reductions on efficiency improvements.

Annual Tax Credit Limits

Annual 25C tax credit limits reset each calendar year. This allows homeowners to split large improvement projects across two years to claim maximum credits.

Installing a heat pump and heat pump water heater in December 2025 claims $2,000 in credits for that tax year. Completing insulation and window upgrades in January 2026 claims an additional $1,800 in credits for 2026.

Stacking Utility Rebates with Tax Credits

Utility rebates generally stack with federal tax credits without limits. Homeowners throughout Ashland, Marietta, Steubenville, and Athens can claim both incentive types on the same improvements.

A $6,000 heat pump installation might qualify for a $1,800 federal tax credit (30%) plus a $500-$750 utility rebate. This reduces net cost to $3,450-$3,700.

Coordinating HOMES and HEAR with Tax Credits

HOMES and HEAR rebates, once available, will stack with utility rebates. However, coordination with 25C tax credits becomes more complex.

IRS guidance clarifies that taxpayers must reduce the purchase price by point-of-sale rebates before calculating tax credits. Post-purchase rebates don’t affect credit calculations. Strategic timing determines whether improvements qualify for maximum combined incentives.

Waiting for HOMES and HEAR Programs

Waiting for HOMES and HEAR program launches benefits households qualifying for income-based rebates. This especially helps when improvements would exceed 25C annual credit limits.

A low-income household installing a $12,000 heat pump might receive an $8,000 HEAR rebate plus utility rebates. Remaining costs of $3,000-$3,500 qualify for $900-$1,050 tax credits.

When to Proceed Immediately

Immediate improvements make sense for households not qualifying for income-based rebates. They also make sense when addressing urgent efficiency needs.

Delaying necessary HVAC replacements, insulation upgrades, or weatherization waiting for programs costs money through continued energy waste. It also risks equipment failures.

Contractor Pricing and Seasonal Factors

Contractor availability and pricing affect timing strategies significantly. Peak season HVAC installations in Chillicothe, Portsmouth, and Waverly during summer cooling season often command premium pricing.

Off-season winter or spring installations may offer 10-20% lower costs. These seasonal price differences can exceed rebate values, making off-season improvements financially optimal.

Multi-Year Improvement Strategies

Multi-year improvement strategies spreading projects across 2025, 2026, and 2027 maximize 25C annual credit limits. This allows addressing priorities sequentially.

Year one might focus on HVAC equipment and electrical upgrades. Year two covers insulation and air sealing. Year three addresses windows and doors. This approach claims $3,000-$3,200 in credits annually.

Eligibility Requirements and Qualifying Equipment

Understanding specific eligibility requirements and qualifying equipment specifications ensures your improvements generate expected tax credits and rebates. Installations not meeting technical requirements or lacking proper documentation may be denied.

Energy Star Certification Requirements

Energy Star certification requirements apply to most equipment qualifying for federal tax credits and utility rebates. Heat pumps, air conditioners, heat pump water heaters, and many other products must display Energy Star labels.

Equipment must also meet specific efficiency thresholds beyond basic Energy Star certification.

Efficiency Rating Minimums for 25C Credits

Efficiency rating minimums for 25C tax credits include 8.0+ HSPF2 (Heating Seasonal Performance Factor 2) for heat pumps. They also require 16+ SEER2 (Seasonal Energy Efficiency Ratio 2).

These updated rating standards implemented in 2023 replaced older HSPF and SEER metrics. Homeowners in Athens, Gallipolis, and Portsmouth must verify contractors quote equipment using current rating systems.

Cold Climate Heat Pump Requirements

Cold climate heat pumps receiving 25C tax credits must meet enhanced specifications. This includes capacity retention at 5°F outdoor temperatures.

Equipment marketed as “cold climate” or “Arctic” heat pumps typically exceeds minimum requirements. This makes them ideal for Southern Ohio and Northern Kentucky’s winter conditions.

Manufacturer Certifications

Manufacturer certifications provide documentation proving equipment meets tax credit requirements. Reputable manufacturers including Mitsubishi, Carrier, Lennox, Trane, and Rheem publish lists of qualifying equipment models.

These lists include efficiency ratings and certification statements homeowners need for tax filings.

Installation Requirements

Installation requirements for some rebates and tax credits include professional contractor installation. They also specify particular installation practices.

DIY improvements may not qualify for certain incentives. This particularly affects utility rebates requiring contractor verification and 25D credits for solar and geothermal systems requiring licensed installer certifications.

Documentation Requirements

Documentation requirements for tax credits include manufacturer certifications and receipts showing purchase prices and installation costs. Contractor invoices detailing work performed are also required.

Homeowners throughout Ashland, Marietta, and Steubenville should retain all documentation for at least seven years in case of IRS audits or questions.

Product Testing and Verification

Product testing and verification for insulation and air sealing improvements often requires blower door testing, thermal imaging, or energy modeling. Contractors performing weatherization improvements should provide test results.

Documentation should include R-values achieved, air leakage reductions, and energy savings estimates supporting rebate applications.

Property Ownership Requirements

Property ownership requirements limit most incentives to property owners, excluding renters from tax credits and utility rebates. Some utility programs offer renter participation through landlord cooperation.

Homeowners receive the vast majority of available incentives throughout our region.

Primary Residence Requirements

Primary residence requirements apply to 25C tax credits. Claims are limited to homes where taxpayers live most of the year.

Vacation homes, rental properties, and investment properties generally don’t qualify for residential efficiency tax credits. Commercial building efficiency credits may apply to rental properties.

Application Processes and Required Documentation

Successfully claiming tax credits and rebates requires understanding specific application processes, deadlines, and documentation requirements for each program. Missing steps or lacking documentation can delay or prevent incentive payments.

Federal Tax Credit Claims

Federal tax credit claims occur when filing annual tax returns using IRS Form 5695 (Residential Energy Credits). This form requires listing qualifying improvements made during the tax year.

You’ll report equipment costs, installation costs, and calculated credit amounts. TurboTax, H&R Block, and other tax software programs include guided sections for energy credit calculations.

Obtaining Manufacturer Certifications

Manufacturer certifications proving equipment qualifies for 25C or 25D credits must be obtained at time of purchase. You can also download them from manufacturer websites.

Most major manufacturers provide searchable databases. Homeowners can verify specific model numbers meet tax credit requirements and download certification PDFs for tax filing.

Receipt Documentation

Detailed receipts showing total project costs including equipment, materials, and installation labor support tax credit calculations. IRS audits may request documentation proving claimed amounts.

Thorough recordkeeping proves essential for homeowners throughout Athens, Gallipolis, Portsmouth, and Chillicothe.

Utility Rebate Applications

Utility rebate applications typically require online submission through utility company websites. Paper forms submitted by mail also work.

Applications must include equipment model numbers, efficiency ratings, proof of purchase, installation verification, and sometimes contractor certification that work meets program requirements.

Pre-Approval Requirements

Pre-approval requirements for some utility rebates mean homeowners must apply before completing improvements. These pre-approval programs reserve rebate funding and confirm equipment choices qualify before purchase.

This avoids disappointment when non-qualifying equipment doesn’t generate expected rebates.

Contractor-Processed Rebates

Contractor-processed rebates through utility programs simplify applications. Contractors handle paperwork and provide instant point-of-sale discounts.

Homeowners in Ashland, Marietta, Steubenville, and surrounding areas should ask contractors which rebate programs they participate in. Ask whether they offer instant rebate processing.

Post-Installation Inspections

Post-installation inspections may be required for certain utility rebates. This particularly affects large insulation projects or comprehensive weatherization improvements.

Utility representatives or third-party verifiers schedule inspections to confirm work was completed as described. They verify work meets program requirements.

HOMES and HEAR Application Process

HOMES and HEAR rebate applications, once programs launch, will likely require pre-approval based on energy modeling. Contractor estimates and household income verification will also be needed.

Point-of-sale discounts will be processed by participating contractors enrolled in state programs. Homeowners provide income documentation and project approvals.

Processing Timelines

Processing timelines vary dramatically by program. Federal tax credits provide refunds or reduce tax owed when filing returns. This typically occurs within weeks of IRS processing.

Utility rebates may take 4-12 weeks from application submission to check receipt. Contractor-processed instant rebates eliminate waiting periods.

Common Mistakes and How to Avoid Them

Homeowners throughout Southern Ohio and Northern Kentucky frequently make costly mistakes when pursuing efficiency rebates and tax credits. Understanding these common errors helps you maximize incentives while avoiding delays or denials.

Failing to Verify Equipment Qualifications

Failing to verify equipment qualifications before purchase represents the most expensive mistake. Many homeowners assume any high-efficiency equipment qualifies for tax credits.

However, specific efficiency thresholds, Energy Star certification, and manufacturer certifications are required. Always verify equipment model numbers appear on manufacturer tax credit lists before purchasing.

Missing Annual Tax Credit Deadlines

Missing annual tax credit deadlines or limits costs thousands in lost incentives. The 25C credit provides $3,200 maximum annually across all qualifying improvements, not per improvement category.

Homeowners installing heat pumps ($2,000 credit), insulation ($1,200 credit), and windows ($600 credit) in one year would hit the $3,200 annual limit. This loses $600 in potential credits that could have been claimed by splitting projects across two years.

Confusion About Efficiency Ratings

Incorrect efficiency rating systems create confusion and potential denial of credits. New SEER2 and HSPF2 ratings implemented in 2023 replaced older SEER and HSPF metrics.

Some contractors and manufacturers still reference old rating systems. Equipment meeting old SEER 16 standards might not meet new SEER2 16 requirements. Homeowners must verify current rating systems.

DIY Installation Issues

DIY installation for improvements requiring professional contractor verification eliminates eligibility for many utility rebates. Federal tax credits often allow DIY improvements (except solar and geothermal).

However, utility programs throughout Athens, Gallipolis, Portsmouth, and Maysville typically require licensed contractor installation with verification.

Assuming State Rebates Are Available

Assuming state rebate programs are available causes costly delays. Ohio and Kentucky have not yet launched HOMES and HEAR programs despite federal funding authorization in 2022.

Homeowners waiting indefinitely for these programs while suffering high energy bills from inefficient equipment lose more money than anticipated rebates would save.

Not Stacking Available Incentives

Not stacking available incentives leaves money on the table. Many homeowners claim federal tax credits but never investigate utility rebates. Others claim utility rebates without realizing federal tax credits also apply.

A heat pump installation might qualify for $1,800 federal tax credit plus $500-$750 utility rebate. Homeowners unaware of both programs lose half their potential savings.

Poor Documentation Retention

Poor documentation retention risks credit denial during audits. IRS requires homeowners to substantiate tax credit claims with manufacturer certifications, detailed receipts, and installation documentation.

Throwing away paperwork or lacking manufacturer certification PDFs means lost credits if the IRS requests verification years after improvements.

Misunderstanding Income Limits

Misunderstanding income limits for HOMES and HEAR programs creates false expectations. These programs serve households earning below 150% of area median income.

Many middle and upper-income households won’t qualify despite federal funding. Understanding AMI limits by county helps homeowners throughout Ashland, Steubenville, and Marietta determine eligibility.

Claiming Credits for Rental Properties

Claiming credits for improvements made to rental properties or vacation homes violates 25C requirements. Credits are limited to primary residences.

Investment property improvements don’t qualify for residential energy credits. Commercial building efficiency incentives may be available under different IRS programs.

Ignoring Contractor Quality

Ignoring contractor quality while chasing rebates produces poor installations that waste money despite incentives. Choosing contractors solely because they process utility rebates creates problems.

Verify references, licensing, and installation quality. Poor contractors lead to improperly sized equipment, poor installation practices, and long-term problems exceeding initial savings.

Energy Audits and Professional Assessments

Professional energy audits identify the most cost-effective improvements for your home. They also generate 25C tax credits up to $150. Understanding what comprehensive audits include helps you choose qualified auditors.

Home Performance with Energy Star Audits

Home Performance with Energy Star audits through utility programs or independent contractors provide comprehensive assessments. These include blower door testing, thermal imaging, combustion safety testing, and detailed improvement recommendations.

These audits cost $300-$600 throughout Ashland, Marietta, Steubenville, and Athens. They qualify for $150 tax credits and often include utility rebates reducing net costs to $100-$300.

Blower Door Testing

Blower door testing measures air leakage rates by pressurizing homes and identifying infiltration locations. Audit results quantify air changes per hour (ACH).

Older homes throughout our region typically show 8-15 ACH when 3-5 ACH represents efficient performance. Test results guide air sealing improvements delivering maximum return on investment.

Thermal Imaging

Thermal imaging cameras reveal insulation gaps, air leakage paths, moisture intrusion, and thermal bridging invisible to naked eyes. Auditors scan exterior walls, ceilings, and floors while homes are heated or cooled.

Infrared images show temperature differentials indicating problems. These images provide powerful visual evidence supporting improvement recommendations.

Combustion Safety Testing

Combustion safety testing ensures furnaces, water heaters, and other fuel-burning appliances vent properly. Testing confirms they don’t create carbon monoxide hazards.

Auditors test draft pressures, measure carbon monoxide levels, and verify adequate combustion air supply. This proves particularly important in older homes throughout Portsmouth, Chillicothe, and Waverly with aging equipment.

Duct Leakage Testing

Duct leakage testing measures air loss from ductwork. Tests typically reveal 20-40% losses in older systems throughout Southern Ohio and Northern Kentucky.

Auditors pressurize duct systems and measure leakage rates. This identifies whether duct sealing improvements should be prioritized ahead of equipment upgrades.

Energy Modeling Software

Energy modeling software used by qualified auditors calculates current energy consumption. Software models improvement scenarios and predicts savings from each potential upgrade.

Detailed reports rank improvements by cost-effectiveness. This helps homeowners prioritize projects delivering maximum savings per dollar invested.

Qualified Auditor Certifications

Qualified auditors hold certifications from the Building Performance Institute (BPI) or the Residential Energy Services Network (RESNET). Similar professional organizations provide certifications.

These certifications require technical training, field experience, and examination. They demonstrate competence in building science, diagnostics, and improvement recommendations.

Audit Return on Investment

Audit costs generally pay for themselves by identifying high-impact improvements homeowners wouldn’t have otherwise prioritized. Many homeowners in Gallipolis, Maysville, and Henderson assume new windows are their highest priorities.

Audits often reveal air sealing and insulation deliver 3-5 times greater savings per dollar invested.

Utility-Sponsored Audits

Utility-sponsored free or low-cost audits provide basic assessments. Scope may be limited compared to comprehensive paid audits.

Duke Energy, AEP Ohio, LG&E/KU, and other utilities offer walk-through assessments or online tools estimating savings from various improvements. These represent good starting points before investing in detailed audits.

Post-Improvement Verification

Post-improvement verification testing documents achieved results. Testing provides data for HOMES rebate applications.

Auditors perform follow-up blower door and thermal imaging after improvements. This verifies air leakage reductions and insulation effectiveness. Verification tests cost $150-$300 but generate documentation proving energy savings percentages required for some rebate programs.

Regional Priorities: Where to Start

Southern Ohio and Northern Kentucky’s climate, housing stock, and energy costs create specific priorities. Understanding regional characteristics helps homeowners allocate limited budgets to highest-impact projects.

Attic Insulation Upgrades

Attic insulation upgrades deliver exceptional returns throughout our region. Most pre-1990 homes have R-19 or less insulation despite R-49-R-60 current recommendations.

Adding 10-12 inches of blown fiberglass or cellulose costs $1,500-$3,000 for typical homes in Athens, Gallipolis, and Portsmouth. This reduces heating and cooling costs by 15-25% annually.

Air Sealing Improvements

Air sealing improvements complement insulation by preventing conditioned air loss. Sealing occurs around windows, doors, penetrations, and attic hatches.

Comprehensive air sealing costing $800-$1,500 reduces heating bills by 10-20%. This particularly helps older homes throughout Ashland, Steubenville, and Marietta with typical air leakage rates of 10-15 air changes per hour.

Heat Pump Replacements

Heat pump replacements for homes with electric resistance heating or aging air conditioning systems deliver substantial savings. Improvements come through improved efficiency and federal tax credits.

Cold climate heat pumps costing $8,000-$14,000 before incentives reduce heating costs by 40-60% compared to electric baseboards or furnaces. They provide efficient cooling as well.

Crawl Space Encapsulation

Crawl space encapsulation addresses moisture problems common throughout our region’s high-humidity climate and clay soils. Encapsulation costing $4,000-$8,000 for typical crawl spaces reduces humidity and prevents mold growth.

It also improves floor comfort and reduces HVAC loads by preventing moisture infiltration and air leakage through floors.

Heat Pump Water Heaters

Heat pump water heater replacements save $250-$400 annually compared to electric resistance water heaters. This applies throughout Chillicothe, Waverly, and Henderson where electricity rates make conventional water heating expensive.

Units costing $1,800-$2,500 installed qualify for $2,000-$2,290 in combined tax credits and rebates. They pay for themselves in 1-2 years through energy savings.

Basement Insulation

Basement insulation for unconditioned basements prevents heat loss through foundation walls. It also reduces floor discomfort in first-floor living spaces.

Insulating basement walls with R-15 rigid foam costs $2,500-$4,500 for typical basements. This improves comfort dramatically while qualifying for 25C tax credits and utility rebates.

Window Replacement Considerations

Window replacements rank lower in cost-effectiveness compared to insulation and air sealing. This occurs despite being homeowners’ most requested improvements.

New windows provide 10-20% heating savings while costing $6,000-$15,000 for whole-home replacement. Prioritizing insulation and air sealing first delivers greater savings per dollar invested. Windows do improve comfort, appearance, and resale value.

Duct Sealing and Insulation

Duct sealing and insulation for homes with forced-air systems prevents 20-40% energy losses typical in older ductwork throughout our region. Professional duct sealing using Aeroseal technology costs $1,500-$3,000.

This improves comfort dramatically while qualifying for utility rebates and reducing equipment runtime.

Smart Thermostats

Smart thermostats costing $150-$300 installed reduce energy costs by 10-15% through improved scheduling and automatic setbacks. These devices qualify for utility rebates and pay for themselves in 1-2 years.

They provide remote control convenience and usage tracking as well.

Long-Term Planning: 2026-2030 Improvement Strategy

Strategic multi-year planning maximizes total incentives while spreading improvement costs across manageable annual budgets. Understanding how tax credit limits, rebate availability, and equipment lifecycles interact helps homeowners create comprehensive efficiency roadmaps.

2026 Priorities

Year 2026 priorities should focus on available incentives and urgent needs. Homes with failing HVAC equipment, inadequate insulation, or severe air leakage should address these issues immediately.

Use current 25C tax credits and utility rebates. Waiting for uncertain HOMES and HEAR program launches risks equipment failures and continued energy waste exceeding anticipated rebate values.

Monitoring HOMES and HEAR Program Launches

Monitor HOMES and HEAR program launches throughout 2026. Adjust strategies accordingly if programs launch with substantial point-of-sale rebates.

Qualifying households should prioritize improvements offering maximum combined incentives. If delays continue, proceed with planned improvements using available tax credits and utility rebates.

Equipment Replacement Timing

Equipment replacement timing should consider both incentive availability and equipment lifecycle. Furnaces and air conditioners typically last 15-20 years. Water heaters last 10-15 years.

Replacing equipment proactively when incentives are maximized saves more than waiting for failures. You must then accept whatever equipment is immediately available regardless of incentive optimization.

Insulation and Weatherization Investments

Insulation and weatherization improvements have indefinite lifespans. This makes these investments valuable regardless of incentive timing.

Cellulose and fiberglass insulation lasts 80-100 years. Air sealing benefits persist indefinitely. These improvements deliver returns through reduced energy costs for decades beyond initial payback periods.

Renewable Energy Planning

Renewable energy investments like solar panels make increasing sense as electricity rates rise and technology costs decline. The 30% federal tax credit with no upper limit remains available through 2032.

This provides planning flexibility for homeowners considering $15,000-$40,000 solar installations throughout Athens, Steubenville, and Marietta.

Electrification Strategies

Electrification strategies preparing for future carbon-reduction requirements might include upgrading electrical service to 200 amps. Installing heat pumps and heat pump water heaters also helps.

Planning for electric vehicle charging prepares homes as well. These improvements position homes for evolving energy standards while qualifying for current substantial incentives.

Multi-Year Budget Allocation

Budget allocation across multiple years allows homeowners to claim maximum 25C credits annually. A comprehensive plan might include different yearly focuses.

2026 might cover heat pump and electrical upgrade ($2,600 in credits). 2027 addresses insulation and air sealing ($1,800 in credits). 2028 handles windows and heat pump water heater ($2,600 in credits). This claims $7,000 total credits over three years.

Conclusion

Energy efficiency rebates and tax credits in 2026 provide unprecedented opportunities for homeowners throughout Southern Ohio and Northern Kentucky. Federal tax credits totaling up to $3,200 annually through the 25C program offer substantial savings. Unlimited 25D credits for solar and geothermal systems provide even more benefits.

Utility rebates ranging from $100-$1,500 per improvement add to savings. Anticipated HOMES and HEAR rebates offering up to $14,000 for qualifying households create powerful financial incentives. These programs make efficiency upgrades affordable.

Homeowners in Ashland, Marietta, Steubenville, Athens, Gallipolis, Mt. Orab, Maysville, Paducah, Owensboro, Henderson, Portsmouth, Chillicothe, and Waverly should prioritize improvements delivering maximum energy savings. Focus on insulation, air sealing, and heat pump installations that qualify for multiple stacked incentives.

Strategic timing spreading improvements across multiple years maximizes annual tax credit limits. This allows addressing priorities sequentially while managing costs effectively.

Success requires understanding specific eligibility requirements and qualifying equipment specifications. You must also navigate application processes and documentation requirements for each incentive program.

Working with qualified contractors experienced in processing rebates ensures proper documentation. Quality contractors provide high-quality installations delivering promised energy savings.

These incentive programs represent limited-time opportunities. The 25C credits extend through 2032 but could be reduced or eliminated by future legislation. Utility rebates fluctuate based on program funding.

Taking advantage of current generous incentives transforms expensive efficiency improvements into affordable investments. These upgrades reduce energy costs and improve comfort for decades to come.

Frequently Asked Questions About Energy Efficiency Rebates & Tax Credits

Q: Can I claim both federal tax credits and utility rebates for the same improvement, or do I have to choose one or the other?

A: You can absolutely stack federal tax credits with utility rebates on the same improvements. They don’t reduce each other and both can be claimed simultaneously.

For example, a $6,000 heat pump installation throughout Ashland, Marietta, or Steubenville would qualify for a $1,800 federal 25C tax credit (30% of cost). It also qualifies for a $500-$750 utility rebate from Duke Energy, AEP Ohio, or Kentucky Power.

The utility rebate doesn’t reduce the purchase price for tax credit calculation purposes. The tax credit doesn’t affect utility rebate eligibility.

This stacking principle applies to virtually all improvements covered by 25C credits. Insulation projects can claim tax credits plus utility per-square-foot rebates. Smart thermostats can claim tax credits plus $50-$100 utility rebates. Heat pump water heaters can claim tax credits plus utility rebates.

The exception involves HOMES and HEAR point-of-sale rebates once available. IRS guidance requires reducing purchase prices by these rebates before calculating tax credits, since they’re applied at time of purchase. However, utility rebates received after purchase don’t affect tax credit calculations.

Homeowners throughout Athens, Gallipolis, Portsmouth, and surrounding areas should always pursue both incentive types to maximize savings. Typical combined incentives reduce improvement costs by 35-50%.

Q: How do I know if my income qualifies for the new HOMES and HEAR rebate programs, and when will these programs be available in Ohio and Kentucky?

A: HOMES and HEAR eligibility depends on Area Median Income (AMI) for your specific county and household size. HEAR serves households earning up to 150% AMI. HOMES provides enhanced rebates for those under 80% AMI.

AMI varies dramatically by county. Athens County’s median income differs significantly from Hamilton County (Cincinnati) or Boone County, Kentucky. As a rough estimate, 150% AMI for a family of four ranges from $90,000-$120,000 in most Southern Ohio and Northern Kentucky counties. You must verify exact figures for your county when programs launch.

Both Ohio and Kentucky received federal HOMES and HEAR funding but have experienced delays in program implementation. Original expectations targeted late 2024 or early 2025. Current projections suggest potential launches in late 2025 or 2026. No official dates have been confirmed by either state’s energy offices.

Homeowners can monitor the Ohio Development Services Agency (ODSA) and Kentucky Housing Corporation websites for program announcements. Contact your utility companies as they will likely participate in program administration.

The critical question for homeowners throughout Chillicothe, Waverly, Henderson, and Owensboro is whether to wait for these programs or proceed with improvements using currently available incentives. If you have urgent needs like failing equipment or severe efficiency problems, proceeding now makes sense. Use 25C tax credits and utility rebates rather than waiting indefinitely for programs that might not launch for 12-24 months.

Q: If I replace my old furnace with a new heat pump, can I claim the full $2,000 tax credit, or are there limitations based on what I’m replacing?

A: The 25C tax credit for heat pumps provides 30% of equipment and installation costs up to $2,000 maximum annually. This applies regardless of what equipment you’re replacing.

Whether you’re replacing an old furnace, an existing heat pump, electric baseboard heaters, or adding heating/cooling to a previously unconditioned space, the credit calculation remains the same. Calculate 30% of total project costs up to the $2,000 annual limit.

A $6,667+ heat pump installation hits the maximum $2,000 credit. A $4,000 installation generates a $1,200 credit. The key requirement is that the new heat pump must meet efficiency standards. It needs 8.0+ HSPF2 and 16+ SEER2, which virtually all modern cold climate heat pumps exceed.

Homeowners throughout Ashland, Steubenville, and Marietta replacing aging equipment with high-efficiency heat pumps can claim the full credit amount. Base the credit on project costs, not efficiency improvements over old equipment.

This differs from some utility rebates which offer higher amounts when replacing electric resistance heating versus replacing existing heat pumps.

Additionally, if you install multiple qualifying improvements in the same year, remember the $2,000 heat pump credit is separate from other credits. The $1,200 insulation/air sealing credit and $600 window credit are separate. You can claim all of them up to the $3,200 total annual 25C limit.

However, you cannot claim separate heat pump credits for multiple heat pump installations in the same year. The $2,000 maximum applies to all heat pump installations combined annually.

Q: Do I need to hire a contractor to qualify for tax credits and rebates, or can I do the work myself and still claim the incentives?

A: Federal 25C tax credit eligibility for DIY installations varies by improvement type. Utility rebates almost always require professional contractor installation.

You can claim 25C tax credits for DIY insulation, air sealing, windows, and doors, provided you purchase qualifying materials and can document costs. You can potentially claim credits for smart thermostats as well.

However, heat pumps, heat pump water heaters, and other mechanical equipment improvements require professional installation. This meets building codes and manufacturer warranty requirements. Realistically, you won’t install these yourself.

The 25D credits for solar panels, geothermal heat pumps, and battery storage specifically require professional licensed contractor installation. This makes DIY work ineligible.

Utility rebates from Duke Energy, AEP Ohio, Kentucky Power, and LG&E/KU uniformly require professional contractor installation with verification. This often requires contractors enrolled in specific rebate programs.

These programs use contractor verification to ensure work meets quality standards and achieves promised energy savings.

Homeowners throughout Athens, Gallipolis, Portsmouth, and Maysville might save installation costs through DIY insulation or air sealing. However, they sacrifice utility rebates worth $200-$600 that often exceed DIY labor savings.

Additionally, professional contractors provide warranties and building code compliance. They ensure proper installation techniques, especially critical for air sealing and moisture management in our humid climate. They also provide blower door testing documentation proving results.

For most homeowners, professional installation makes financial sense when accounting for combined tax credits, utility rebates, quality assurance, and time savings. This applies even though DIY work technically qualifies for tax credits in some categories.

Q: I installed new windows and a heat pump last year (2024) but forgot to claim the tax credits on my return—can I still get these credits, and what do I need to do?

A: Yes, you can claim missed energy efficiency tax credits from previous years by filing an amended tax return. Use IRS Form 1040-X (Amended U.S. Individual Income Tax Return) along with Form 5695 showing your eligible improvements and calculated credits.

You have three years from your original tax return filing deadline to file amended returns claiming missed credits. This means 2024 improvements can be claimed through amended returns filed until April 15, 2028.

The process involves obtaining Form 1040-X and completing Form 5695 with your 2024 improvement details. Gather manufacturer certifications and receipts you should have retained. Submit the amended return to the IRS.

If you didn’t keep manufacturer certifications proving your equipment met tax credit requirements, visit manufacturer websites. Most provide searchable databases allowing you to verify specific model numbers qualified. You can download certification PDFs.

For windows installed in 2024, you’ll use old Energy Star v6.0 requirements and previous tax credit rules. These had different limits than current 2025 rules. Verify 2024-specific requirements rather than current guidelines.

Homeowners throughout Ashland, Marietta, Steubenville, and surrounding areas who missed claiming credits for 2022, 2023, or 2024 improvements should act promptly. The statute of limitations is three years. After that, unclaimed credits are permanently lost.

If the missed credits would have reduced your tax owed, you’ll receive a refund of the overpaid amount plus interest. If you had no tax liability to offset, tax credits don’t carry forward. They don’t generate refunds beyond your tax owed.

Consider consulting a tax professional if you’re uncertain about amended return procedures. Get help especially if you’re claiming substantial credits exceeding $3,000-$4,000 across multiple years.