Last Updated: January 2026

Key Takeaways

- Multiple financing paths exist for Cincinnati bathroom remodels, from home equity options to personal loans and contractor financing programs

- Home equity products typically offer the lowest rates (currently 7-9% in the Cincinnati market) but require sufficient equity and home appraisal

- Cincinnati’s median home values ($235,000-$285,000 depending on neighborhood) impact how much equity homeowners can access

- Personal loans provide faster approval (often 24-48 hours) without using your home as collateral, though rates run higher (9-18%)

- Strategic financing choices can save thousands over the loan term—a $25,000 renovation financed at 8% versus 14% saves approximately $3,200 over five years

- Cincinnati-area credit unions often provide better terms than national lenders for local homeowners

- Government programs and utility rebates can offset costs for energy-efficient upgrades common in Ohio Valley bathroom renovations

Finding the right bathroom remodel financing Cincinnati option transforms your renovation from wishful thinking into reality. Whether you’re updating a vintage bathroom in Hyde Park, modernizing a dated space in Mason, or creating an accessible bathroom in Anderson Township, understanding your financing choices helps you move forward with confidence and the lowest possible costs.

The Cincinnati housing market presents unique considerations for bathroom renovation budgets. With home values ranging from $180,000 in more affordable neighborhoods to $400,000+ in premium areas like Indian Hill and Montgomery, the amount of equity available—and therefore your financing options—varies significantly across the metro area.

This guide examines every major financing avenue available to Cincinnati homeowners, from traditional home equity products to innovative contractor financing programs. We’ll explore how each option works, what it costs, and which situations favor each approach.

Understanding Cincinnati’s Bathroom Financing Landscape

The typical bathroom remodel in the Cincinnati area ranges from $12,000 for a basic refresh to $45,000+ for a complete luxury renovation. Most homeowners invest between $18,000 and $28,000 for a mid-range full bathroom remodel that includes new fixtures, tile work, vanity, and updated lighting.

Several factors shape Cincinnati’s bathroom financing market:

Home equity availability: Cincinnati’s steady appreciation over the past decade means many homeowners who purchased before 2020 have significant equity to access. Homes in established neighborhoods like Oakley, Mount Lookout, and Mariemont have appreciated 25-40% since 2019, creating substantial equity positions.

Regional banking landscape: Cincinnati benefits from both major national lenders and strong regional institutions. US Bank, Fifth Third Bank, and PNC maintain significant presences here, while credit unions like Wright-Patt Credit Union and Cincinnati Federal Credit Union often provide competitive terms for members.

Contractor financing evolution: Many Cincinnati-area remodeling contractors have partnered with financing companies to offer point-of-sale financing options. This trend accelerated after 2020, making it easier to finance your project directly through your chosen contractor.

Income and credit considerations: The Cincinnati metro area’s median household income ($63,000-$75,000 depending on the county) and above-average credit scores (typically 690-720) mean most homeowners qualify for mid-tier financing terms, though premium rates remain available for those with excellent credit.

Home Equity Loans and HELOCs

For Cincinnati homeowners with established equity, home equity products typically offer the most cost-effective path to pay for bathroom renovation Ohio projects. These options leverage your home’s value to secure favorable interest rates.

Home Equity Loans (Second Mortgages)

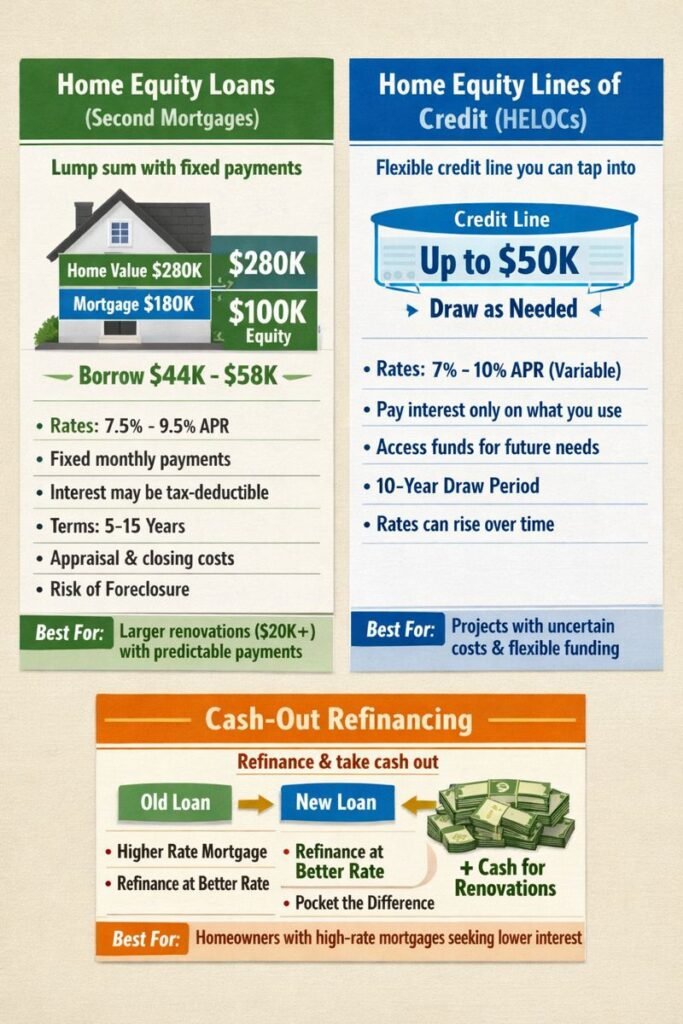

A home equity loan provides a lump sum with fixed monthly payments over a set term, typically 5-15 years. You borrow against your accumulated equity, receiving the entire amount upfront.

How it works in Cincinnati: If your home is worth $280,000 and you owe $180,000 on your mortgage, you have $100,000 in equity. Most lenders will allow you to borrow up to 80-85% of your home’s value minus your existing mortgage, giving you access to approximately $44,000-$58,000.

Current rates in the Cincinnati market: As of January 2026, home equity loans typically range from 7.5% to 9.5% APR for qualified borrowers. Your actual rate depends on credit score, loan-to-value ratio, and lender.

Advantages for bathroom renovations:

- Fixed interest rates provide predictable monthly payments

- Lower rates than most alternatives save money over the loan term

- Interest may be tax-deductible if the renovation increases home value (consult your tax advisor)

- Longer repayment terms (10-15 years) keep monthly payments manageable

Considerations:

- Application process takes 3-6 weeks including home appraisal

- Closing costs typically run $500-$1,500

- Your home serves as collateral—missed payments risk foreclosure

- You’re borrowing the full amount even if your project costs less than estimated

Best for: Homeowners with established equity planning larger renovations ($20,000+) who want predictable payments and the lowest possible interest rate.

Home Equity Lines of Credit (HELOCs)

A HELOC functions like a credit card secured by your home, providing a revolving line of credit you can draw from as needed. This flexibility makes HELOCs particularly attractive for bathroom renovations where final costs may shift as the project unfolds.

How it works: You’re approved for a maximum credit line (say, $50,000) and can withdraw funds as needed during the “draw period” (typically 10 years). You only pay interest on what you actually borrow.

HELOC rates in Cincinnati: Most HELOCs carry variable rates currently ranging from 7% to 10% APR, tied to the prime rate. Some lenders offer fixed-rate options for a premium.

Advantages for bathroom projects:

- Pay interest only on funds you actually use

- Draw additional funds if the project scope expands

- During draw period, often only pay interest (not principal)

- Reusable line of credit for future projects

Considerations:

- Variable rates mean payments can increase if rates rise

- After draw period ends, repayment period begins with principal plus interest

- Similar approval timeline and costs to home equity loans

- Requires discipline not to overborrow

Best for: Homeowners who want flexibility to draw funds as needed, especially for phased renovations or projects where final costs are uncertain.

Cash-Out Refinancing

If current mortgage rates are favorable relative to your existing rate, cash-out refinancing lets you refinance your mortgage for more than you owe and pocket the difference for your bathroom remodel.

Cincinnati market context: With many homeowners locked into 3-4% mortgages from 2020-2021, cash-out refinancing makes less sense in 2026 unless you can secure a rate comparable to your existing mortgage. However, homeowners with higher-rate mortgages (6%+) may benefit from exploring this option.

Best for: Homeowners with high existing mortgage rates who can refinance at similar or lower rates while accessing renovation funds.

Quick Comparison: For a $25,000 bathroom remodel, a home equity loan at 8% APR over 10 years costs $303/month with $11,360 in total interest. A personal loan at 12% APR over 5 years costs $556/month with $8,360 in total interest—lower total cost but higher monthly payment.

Personal Loans for Bathroom Renovations

Personal loans for bathroom renovation loans offer a faster, simpler path than home equity products, though typically at higher interest rates. These unsecured loans don’t require your home as collateral and can fund projects from $5,000 to $50,000.

How Personal Loans Work

You borrow a fixed amount with a fixed interest rate, repaying through equal monthly installments over 2-7 years. Approval happens quickly—often within 24-48 hours—and funds typically arrive within a week.

Interest rates in Cincinnati: Personal loan rates vary widely based on creditworthiness:

- Excellent credit (740+): 9-12% APR

- Good credit (670-739): 12-16% APR

- Fair credit (580-669): 16-24% APR

Where to Find Personal Loans

National online lenders: Companies like SoFi, LightStream, and Marcus by Goldman Sachs offer competitive rates for qualified borrowers. LightStream specifically markets home improvement loans with rates as low as 8.99% APR for excellent credit.

Regional banks: Fifth Third Bank and PNC often provide relationship discounts if you maintain checking accounts or other products with them.

Credit unions: Wright-Patt Credit Union and Cincinnati Federal Credit Union frequently beat bank rates by 1-2 percentage points for members.

Advantages of Personal Loans

- No home appraisal or collateral required

- Fast approval and funding (days versus weeks)

- Fixed rates and terms provide payment certainty

- No risk of home foreclosure if you default

- Useful for homeowners with limited equity

Drawbacks to Consider

- Higher interest rates than home equity products

- Shorter repayment terms mean higher monthly payments

- Interest is not tax-deductible

- Borrowing limits may not cover larger renovations

Best for: Homeowners who need quick funding, have limited equity, or prefer not to use their home as collateral for smaller to mid-sized bathroom remodels ($8,000-$25,000).

Credit Card Financing Options

Credit cards offer the fastest access to funds for bathroom renovations, though they typically carry the highest interest rates if you carry a balance beyond promotional periods.

0% APR Promotional Cards

Several major credit cards offer 12-21 months of 0% APR on new purchases. If you can pay off your bathroom remodel within the promotional period, this approach costs nothing beyond any annual fee.

Popular options include:

- Citi Diamond Preferred Card (21-month 0% intro APR)

- Wells Fargo Reflect Card (18-month 0% intro APR)

- Chase Freedom Unlimited (15-month 0% intro APR with rewards)

Strategy for success: For a $15,000 bathroom remodel on an 18-month 0% card, you’d need to pay $834/month to eliminate the balance before interest kicks in. This requires disciplined budgeting but saves thousands in interest charges.

Home Improvement Store Cards

Lowe’s and Home Depot both operate in the Cincinnati area and offer store-branded credit cards with promotional financing:

Lowe’s Advantage Card: Often provides 6-24 month 0% financing on purchases over certain thresholds ($299+).

Home Depot Consumer Credit Card: Similar promotional offers, though terms vary by promotion.

Strategic use: These cards work well for materials purchases if you’re managing your own project or working with a contractor who allows you to purchase materials separately. However, they won’t help with labor costs.

Cautions with Credit Card Financing

- After promotional periods end, rates typically jump to 18-27% APR

- Deferred interest promotions charge retroactive interest on remaining balances

- High balances can damage your credit utilization ratio

- Payment discipline is essential to avoid expensive interest charges

Best for: Homeowners with strong cash flow who can pay off the balance during promotional periods, or for smaller renovation phases that can be paid quickly.

Contractor Financing Programs

Many Cincinnati-area bathroom remodeling contractors partner with financing companies to offer point-of-sale financing. This streamlined approach lets you apply for financing directly through your contractor.

2026 Remodeling Cost Guide

Don’t get ripped off. See real pricing for bathrooms, kitchens, and HVAC.

Updated for 2026 Market Rates

How Contractor Financing Works

When you’re ready to move forward with your project, your contractor submits a financing application on your behalf. Common financing partners include:

- GreenSky: Offers various loan products from 2.99% to 9.99% APR with terms up to 12 years

- ServiceFinance: Provides options for various credit tiers with same-day approval

- Synchrony HOME Credit: Features promotional periods and longer-term options

- FTL Finance: Specializes in home improvement with flexible approval criteria

Approval process: Most contractor financing decisions happen within minutes to hours, letting you start your project quickly once you select a contractor.

Advantages of Contractor Financing

- Extremely convenient—one-stop shopping for contractor and financing

- Fast approval process doesn’t delay project start

- No money changes hands until work begins

- Payment goes directly to contractor as work progresses

- Some programs offer promotional rates (though deferred interest may apply)

Potential Drawbacks

- Less opportunity to shop rates across multiple lenders

- Contractors may receive fees or incentives from financing companies

- Rates may be higher than home equity or personal loan options

- Limited ability to negotiate terms

- Deferred interest promotions can be costly if balances remain

Questions to Ask Your Contractor

Before committing to contractor financing:

- What interest rates and terms are available for my credit profile?

- Are there origination fees or closing costs?

- Is this deferred interest or true 0% APR financing?

- What happens if the project scope changes?

- Can I pay off the loan early without penalty?

Best for: Homeowners who value convenience and quick project starts, particularly when promotional rates are available and can be paid within promotional periods.

Government and Special Programs

Several government and utility programs can help reduce the cost of bathroom renovations, particularly when incorporating energy-efficient or accessibility improvements.

FHA Title I Property Improvement Loan

The FHA Title I loan program provides government-insured financing for home improvements, including bathroom renovations. These loans don’t require equity and can be easier to qualify for than conventional options.

Loan amounts: Up to $25,000 for single-family homes

Terms: Up to 20 years for loans over $7,500

Requirements: Property must meet FHA standards and serve as your primary residence. You need adequate income to support the payment but requirements are generally more flexible than conventional loans.

Where to apply: Not all lenders offer FHA Title I loans. Check with regional banks and credit unions in the Cincinnati area.

Duke Energy Rebates and Programs

Duke Energy Ohio offers various rebates for energy-efficient home improvements that might apply to bathroom renovations:

Efficient lighting: LED fixtures and ventilation fan upgrades may qualify for rebates

Water heating: Installing an efficient tankless water heater or heat pump water heater during your bathroom remodel may qualify for rebates of $200-$800

Weatherization: Improving insulation and air sealing around bathroom exterior walls may qualify for assistance

Check Duke Energy’s current Home Energy House Call program for personalized recommendations and available incentives.

Home Accessibility Tax Credit

If you’re renovating to improve accessibility—installing a walk-in shower, grab bars, wider doorways, or other ADA-compliant features—you may qualify for federal tax credits or deductions.

Medical expense deduction: Home improvements necessary for medical care may be deductible if they exceed 7.5% of your adjusted gross income. This can include accessibility modifications prescribed by a physician.

State programs: Ohio occasionally offers programs for seniors and disabled homeowners. Check with the Ohio Development Services Agency for current programs.

VA-Backed Loans for Veterans

Veterans may qualify for VA-backed cash-out refinancing or VA home improvement loans. Wright-Patterson Air Force Base’s proximity to Cincinnati means the region has a significant veteran population who may benefit from these programs.

Energy-Efficient Mortgages

If you’re purchasing a home in Cincinnati that needs bathroom renovation, FHA 203(k) rehabilitation loans let you finance both the purchase price and renovation costs in a single mortgage.

Best for: Home buyers planning immediate renovations, as this streamlines financing into one loan with one closing.

How to Choose the Right Financing Option

Selecting the best way to pay for bathroom renovation Ohio projects depends on several personal factors. This decision framework helps you match your situation to the most advantageous option.

Evaluate Your Financial Position

Available equity: If you have substantial home equity and can wait 3-6 weeks for approval, home equity products offer the lowest rates. Cincinnati homeowners who purchased before 2020 typically have strong equity positions.

Credit score: Your credit score dramatically impacts available rates:

- 740+: You qualify for premium rates across all products

- 670-739: Home equity products offer your best rates; personal loans remain viable

- Below 670: Focus on improving credit before applying, or consider contractor financing which may offer approval when banks won’t

Cash flow: Higher monthly income supports shorter-term, higher-payment options like personal loans. If cash flow is tight, longer-term home equity loans provide lower monthly obligations.

Timeline: Need to start immediately? Personal loans (2-5 days) or contractor financing (same-day) beat home equity products (3-6 weeks).

Consider Your Project Scope

Small updates ($5,000-$12,000): Personal loans, 0% APR credit cards, or contractor financing work well. Home equity products involve too much overhead for smaller projects.

Mid-range remodels ($12,000-$25,000): All options are viable. Compare the total cost across products, factoring in interest over the full term.

Major renovations ($25,000+): Home equity products’ lower rates create significant savings. A $30,000 renovation at 8% versus 14% saves approximately $4,200 over five years.

Match Repayment Timeline to Your Situation

Short-term payoff planned (under 18 months): 0% APR credit cards or short-term personal loans make sense if you can manage the payments.

Medium-term (2-5 years): Personal loans or home equity loans work well, depending on which offers better rates for your credit profile.

Long-term (5+ years): Home equity products shine here, as their lower rates compound savings over extended periods.

Account for Closing Costs and Fees

Don’t look only at interest rates—total cost includes fees:

- Home equity loans/HELOCs: $500-$1,500 in closing costs, appraisal fees ($400-$600)

- Personal loans: Often no closing costs, though some lenders charge origination fees (1-5% of loan)

- Contractor financing: Typically no upfront costs, but higher interest rates

- Credit cards: Potential annual fees ($0-$150)

For a $20,000 renovation, a home equity loan at 8% with $1,200 in closing costs may still beat a personal loan at 12% with no fees over five years.

Factor in Tax Implications

Home equity loan interest may be tax-deductible if:

- You use the funds for home improvements

- The improvements increase your home’s value

- You itemize deductions

Personal loan and credit card interest is not tax-deductible. Consult a tax professional to understand how this affects your situation.

Cincinnati-Specific Cost Considerations

Understanding typical bathroom remodel costs in Cincinnati helps you determine appropriate financing amounts and avoid under-borrowing.

Average Bathroom Remodel Costs in Cincinnati

Powder room refresh ($8,000-$15,000): New vanity, toilet, flooring, paint, and fixtures. Common in older Cincinnati homes with small half-baths.

Standard full bathroom remodel ($15,000-$28,000): Complete replacement of tub/shower, vanity, toilet, tile work, fixtures, and lighting. This represents the most common bathroom renovation in the Cincinnati metro.

Primary bathroom luxury remodel ($28,000-$55,000+): High-end finishes, walk-in shower, freestanding tub, double vanity, heated floors, custom tile work. Popular in newer construction areas like Liberty Township and Mason.

Accessibility conversion ($12,000-$35,000): Converting standard bathrooms to accessible spaces with walk-in showers, grab bars, wider doorways, and comfort-height fixtures.

Regional Cost Factors

Labor rates: Cincinnati’s contractor labor rates typically run $75-$125 per hour, moderate compared to coastal markets but reflecting the region’s skilled trades workforce.

Permit requirements: Most Cincinnati-area municipalities require permits for bathroom remodels involving plumbing or electrical changes. Permit costs run $100-$500 depending on scope and jurisdiction.

Ohio Valley climate considerations: Cincinnati’s humidity and temperature swings create specific ventilation and moisture management needs. Quality exhaust fans ($200-$600) and moisture-resistant materials prevent common problems in Ohio Valley bathrooms.

Older home contingencies: Many Cincinnati neighborhoods feature homes built 1920-1970 with plumbing that needs updating. Budget an additional 15-20% contingency for older homes where hidden issues often surface during renovation.

Financing Amount Recommendations

Most financial advisors recommend borrowing no more than you can comfortably repay within five years for home improvements. For Cincinnati’s median household income ($68,000), this suggests maximum borrowing of $25,000-$35,000 for bathroom renovations.

The 5% rule: Keep your monthly payment below 5% of your gross monthly income. For median Cincinnati household income, that’s about $280-$340/month in maximum bathroom remodel payments.

The Application Process

Understanding what lenders require streamlines your bathroom remodel financing Cincinnati application and improves approval odds.

Documents You’ll Need

Regardless of which financing option you choose, gather these documents before applying:

Proof of income:

- Recent pay stubs (2-3 most recent)

- W-2 forms or tax returns (previous two years)

- Bank statements showing regular deposits

- If self-employed: profit/loss statements and business tax returns

Property documentation (for home equity products):

- Current mortgage statement

- Property tax statements

- Homeowners insurance policy

- Recent property assessment or appraisal

Personal identification:

- Government-issued photo ID (driver’s license, passport)

- Social Security card or number

- Proof of residence

Credit information:

- Recent credit report (optional but helpful to review before applying)

- List of current debts and monthly payments

Timeline Expectations

Personal loans: Application in the morning often means approval by afternoon. Funds typically arrive within 3-7 business days.

Home equity loans/HELOCs: Plan for 3-6 weeks total:

- Week 1: Application submission and initial review

- Week 2-3: Home appraisal scheduling and completion

- Week 3-5: Underwriting and approval

- Week 5-6: Closing and fund disbursement

Contractor financing: Same-day approval common, funds available when work begins.

Credit cards: Instant to 7 days for approval, credit available immediately upon approval.

Improving Your Approval Odds

Before applying:

- Check your credit report for errors and dispute any inaccuracies

- Pay down high credit card balances to improve utilization ratio

- Avoid opening new credit accounts in the 3-6 months before applying

- Gather complete documentation to avoid delays

During application:

- Be accurate and honest—inconsistencies trigger additional verification

- Respond promptly to lender requests for additional information

- Maintain stable employment and income

After conditional approval:

- Don’t make major purchases on credit

- Don’t change jobs if possible

- Keep all accounts current

What If You’re Denied?

Denial isn’t permanent. Lenders must provide reasons for denial. Common issues and solutions:

Insufficient income: Consider a smaller loan amount, add a co-borrower, or wait until income increases.

Too much existing debt: Pay down credit cards and other debts to improve debt-to-income ratio before reapplying.

Low credit score: Spend 6-12 months improving credit—pay bills on time, reduce balances, correct errors.

Insufficient equity: Wait for home appreciation, pay down your mortgage, or consider personal loans instead.

Getting the Best Rates and Terms

Even small differences in interest rates create significant savings over multi-year loans. These strategies help you secure the best possible terms.

Shop Multiple Lenders

The comparison rule: Get quotes from at least three lenders before deciding. Rate shopping within a 14-45 day window typically counts as a single credit inquiry, minimizing credit score impact.

Where to shop in Cincinnati:

- National banks: US Bank, PNC, Fifth Third (often offer relationship discounts)

- Regional banks: First Financial Bank, United Bank

- Credit unions: Wright-Patt CU, Cincinnati Federal CU, University of Cincinnati Federal CU

- Online lenders: LightStream, SoFi, Marcus, Upgrade

Leverage Your Credit Score

Credit score tiers create dramatic rate differences. A 40-point improvement can save thousands:

Example: $25,000 bathroom renovation loan over 5 years

- At 680 credit score: 14% APR = $582/month, $9,920 total interest

- At 740 credit score: 10% APR = $531/month, $6,860 total interest

- Savings: $3,060

If your credit score is close to a threshold (670, 700, 740), consider delaying your project 2-3 months while improving your score through on-time payments and balance reduction.

Negotiate Terms

Many aspects of financing are negotiable:

Interest rates: If you receive a better rate from one lender, ask others to match. Many will, especially for well-qualified borrowers.

Closing costs: Some lenders waive appraisal fees or reduce closing costs to win your business, particularly if you have other accounts with them.

Prepayment penalties: Ensure your loan allows prepayment without penalty. Most modern loans do, but verify.

Origination fees: Personal loan origination fees (1-5%) may be negotiable or waivable.

Consider Relationship Discounts

Banks and credit unions often provide rate discounts for existing customers:

- 0.25-0.50% rate reduction for maintaining checking account

- Additional 0.25% discount for automatic payments

- Enhanced terms for high-balance deposit accounts

If you’re comparison shopping, mention your existing relationship and ask about available discounts.

Time Your Application Strategically

End of month/quarter: Loan officers working toward quotas may offer better terms to close deals before deadlines.

Economic conditions: Rates fluctuate with Federal Reserve policy. If rates are trending down, you might wait. If trending up, lock rates quickly.

Spring/summer consideration: Contractor financing demand peaks during prime construction season (April-September). Applying during slower months (October-February) may yield better negotiating position.

Understand the Full Cost

Compare using total cost over the full loan term, not just monthly payment or interest rate:

Example comparison for $20,000 bathroom remodel:

Option A: Home equity loan

- 8% APR, 10 years, $1,000 closing costs

- Monthly payment: $243

- Total cost: $30,124

Option B: Personal loan

- 11% APR, 5 years, no closing costs

- Monthly payment: $435

- Total cost: $26,100

Despite the higher rate, Option B costs less overall due to the shorter term—but requires higher monthly payments. Choose based on which monthly payment fits your budget.

Frequently Asked Questions

What credit score do I need for bathroom remodel financing in Cincinnati?

Credit score requirements vary by financing type. For home equity loans and HELOCs, most Cincinnati lenders prefer scores of 680+, though some approve borrowers at 640+ with higher rates. Personal loans are available starting around 600-620, but expect rates of 16-24% in that range. Contractor financing often approves borrowers in the 580-600 range, making it accessible when other options aren’t. Excellent credit (740+) unlocks the best rates across all products—typically 8-9% for home equity products and 9-12% for personal loans in the current Cincinnati market.

How much equity do I need to qualify for a home equity loan for bathroom renovation?

Most lenders require you to maintain at least 15-20% equity in your home after borrowing. This means you can typically borrow up to 80-85% of your home’s value minus your existing mortgage balance. For example, if your Cincinnati home is worth $250,000 and you owe $150,000, you have $100,000 in equity. At 80% loan-to-value, you could access approximately $50,000 ($250,000 × 80% = $200,000 maximum total debt, minus $150,000 current mortgage). Cincinnati’s steady appreciation since 2020 means many homeowners have built substantial equity, making home equity products viable for bathroom renovations.

Should I use a home equity loan or personal loan for my bathroom remodel?

This decision hinges on your equity position, timeline, and project cost. Home equity loans offer lower interest rates (currently 7.5-9.5% in Cincinnati) but require 3-6 weeks for approval, home appraisal, and closing costs of $500-$1,500. They work best for larger projects ($20,000+) where the rate savings offset the fees and wait time. Personal loans provide faster funding (2-5 days), no closing costs, and no home collateral, but carry higher rates (9-18% depending on credit). They’re ideal for smaller projects ($8,000-$20,000), homeowners with limited equity, or situations requiring quick project starts. For a $25,000 renovation over five years, a home equity loan at 8% saves approximately $3,200 versus a personal loan at 12%.

Can I write off bathroom remodel financing interest on my taxes?

Home equity loan and HELOC interest may be tax-deductible if you use the funds for home improvements that add value to your property and you itemize deductions. The Tax Cuts and Jobs Act limits this deduction to interest on combined mortgage debt up to $750,000 ($375,000 if married filing separately). Personal loan and credit card interest for bathroom renovations is not tax-deductible. Since tax situations vary significantly, consult with a tax professional to understand how your specific bathroom financing affects your Cincinnati tax return. Keep detailed records of all renovation expenses to support potential deductions.

What’s the fastest way to get financing approved for a bathroom remodel in Cincinnati?

Personal loans and contractor financing offer the fastest approval paths. Many online lenders like LightStream and SoFi approve qualified borrowers within 24-48 hours, with funds arriving within a week. Contractor financing through programs like GreenSky or ServiceFinance often provides same-day approval decisions, letting you start your project immediately. Credit cards with 0% promotional APR provide instant access to funds once approved (usually 7-10 days). If you need the lowest rate and can wait, home equity products take 3-6 weeks but save significantly on interest. For Cincinnati homeowners balancing speed and cost, a personal loan from a local credit union like Wright-Patt often provides the best compromise—approval within 2-3 days and competitive rates for members.

Ready to Start Your Project?

Connect with pre-screened contractors in your area.

Get Your Free QuoteRelated Articles

The Complete Guide to Bathroom Remodeling in Cincinnati, Ohio

How Much Does a Bathroom Remodel Cost in Cincinnati?

Small Bathroom Remodel Ideas and Costs in Cincinnati

Bathroom Remodeling Calculator

Walk-In Shower Conversion in Cincinnati: Costs, Options & What to Know

Best Bathroom Fixtures for Cincinnati Homes: Quality vs. Budget Options